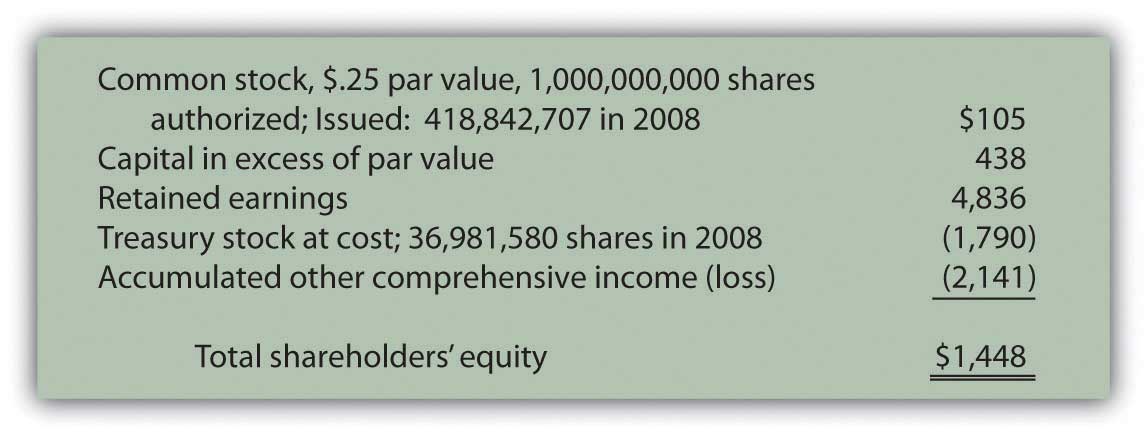

A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. Since equity accounts for total assets and total liabilities, cash and cash equivalents would only represent a small piece of a company’s financial picture. Stockholders’ equity is equal to a firm’s total assets minus its total liabilities.

Risks to know

Nowhere on the stock certificate is it indicated what the stock is worth (or what price was paid to acquire it). In a market of buyers and sellers, the current value of any stock fluctuates moment-by-moment. All companies must report their common stock outstanding on their balance sheet. You can do that by navigating to the company’s investor-relations webpage, finding its financial reporting, and opening up its most recent 10-Q or 10-K filing.

Authorized shares

Dividend yield tells you how much money a company gives to its shareholders. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable. Accounts within this segment are listed from top to bottom in order of their liquidity.

- If a company chooses to repurchase some of its common stock, its assets will decrease by the amount of cash it spends even as stockholders’ equity falls by the same amount.

- Investing in preferred stock from a shaky company is as risky as buying its common stock.

- Looking at the same period one year earlier, we can see that the year-over-year (YOY) change in equity was an increase of $9.5 billion.

- The drawback of common stock ownership for investors is that each stock is accompanied by operational risk related to the venture.

- This gives preferred shareholders a layer of protection, particularly in more challenging economic conditions.

- The calculation of common stock on the balance sheet is also important for valuing the company.

How to Find the Common Stock on a Balance Sheet in Accounting

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

In conclusion, the ability to accurately calculate common stock on a balance sheet empowers individuals to make informed decisions and navigate the complex world of corporate finance with confidence. When most of us think of the stock market, we think of common shares order of operations for starting a startup that are actively traded on exchanges. If you’ve found that your balance sheet doesn’t balance, there’s likely a problem with some of the accounting data you’ve relied on. You may have omitted or duplicated assets, liabilities, or equity, or miscalculated your totals.

The way a company accounts for common stock issuances can seem complicated. However, at its most basic level, the move simply involves crediting or increasing stockholders’ equity. For this exercise, it’s helpful to think of stockholders’ equity as what’s left when a company has paid all its debts, which is sometimes referred to as book value. A stock’s share price can increase, reflecting a rising valuation for the company. Companies sometimes take on debt to buy back their own stock or use stock for employee compensation or acquisition deals. The fact that another class of shares known as preferred stock can function similarly to bonds further muddies the waters.

We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. As with assets, these should be both subtotaled and then totaled together. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. It can be sold at a later date to raise cash or reserved to repel a hostile takeover. There are a few common components that investors are likely to come across.

Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program.